Succession & Exit Strategy for Businesses

The sale or transition of a business will likely be the single largest and most important financial transaction of a business owner’s life and it’s level of success will impact the rest of their life in retirement

20%

Only 20% of businesses put up for sale actually sell.

Selling or Exiting Your Business?

A well-structured exit plan helps business owners:

Avoid unnecessary taxes

Minimize transition risks

Maximize the value of their life's work

Poor succession planning is the biggest threat to family business survival:

50% aim to pass ownership to the next generation

Yet only 30% survive to the 2nd generation, 12% to the 3rd, and just 3% to the 4th

The key to exit planning isn’t just the exit—it’s the strategy behind it.

20%

Only 20% of businesses put up for sale actually sell.

Selling or Exiting Your Business?

A well-structured exit plan helps business owners:

Avoid unnecessary taxes

Minimize transition risks

Maximize the value of their life's work

Poor succession planning is the biggest threat to family business survival:

50% aim to pass ownership to the next generation

Yet only 30% survive to the 2nd generation, 12% to the 3rd, and just 3% to the 4th

The key to exit planning isn’t just the exit—it’s the strategy behind it.

The Four Main Succession & Exit Strategies

Sell to a family member

Half of business owners plan to pass their business to their children, but less than a third succeed. A backup plan for another buyer is essential.

Advantages

The goal is to preserve the family legacy.

It offers financial stability and careers to younger family members.

It allows the owner to work with their children.

It gives the owner control over the business's value.

Disadvantages

It may create family discord and inequality among siblings.

Family members may pay over time instead of cash at closing.

Financial security may suffer if the buyer mismanages the business.

Family dynamics may weaken the new owner's control.

Sell to staff or shareholders

The owner can sell to management via an MBO or LBO, using company assets, or sell to employees through an ESOP.

Advantages

The business stays within the extended family, familiar with it.

Shareholders, managers, and employees know the business's value.

Less risk as management and key employees stay unchanged.

Employee ownership boosts productivity.

Disadvantages

The departing owner may face limited options, reducing value.

Owners may receive little or no upfront cash from the sale.

It may require an outside investor, causing potential conflicts.

ESOPs are complex, costly to set up, and suited for gradual exits.

Sell to an external buyer.

Selling to a third party offers cash-out options through competitors, partners, or investors.

Advantages

The business stays within the extended family, familiar with it.

Usually yields the highest business valuation.

Connects sellers with strategic or synergistic buyers.

Ideal for businesses too valuable for family buyers.

Disadvantages

After selling, an owner may struggle adjusting to an employee role.

Seller financing can expose the seller to risk without proper exit planning.

The process typically takes 9-12 months or longer.

It could lead to the loss of customers and employees.

Liquidate the business.

If unsold, the business may be liquidated when assets exceed cash flow value.

Advantages

The process is quick and straightforward.

The owner can liquidate part of the company while keeping the profitable sections.

Disadvantages

Liquidation usually results in the lowest value, focusing only on assets.

Liquidating a company often costs nearly as much as selling an operating business.

Liquidation leads to job losses, negatively affecting the local community.

It may result in losing customers and employees.

The Four Main Succession & Exit Strategies

Sell to a family member

Half of business owners plan to pass their business to their children, but less than a third succeed. A backup plan for another buyer is essential.

Advantages

The goal is to preserve the family legacy.

It offers financial stability and careers to younger family members.

It allows the owner to work with their children.

It gives the owner control over the business's value.

Disadvantages

It may create family discord and inequality among siblings.

Family members may pay over time instead of cash at closing.

Financial security may suffer if the buyer mismanages the business.

Family dynamics may weaken the new owner's control.

Sell to staff or shareholders

The owner can sell to management via an MBO or LBO, using company assets, or sell to employees through an ESOP.

Advantages

The business stays within the extended family, familiar with it.

Shareholders, managers, and employees know the business's value.

Less risk as management and key employees stay unchanged.

Employee ownership boosts productivity.

Disadvantages

The departing owner may face limited options, reducing value.

Owners may receive little or no upfront cash from the sale.

It may require an outside investor, causing potential conflicts.

ESOPs are complex, costly to set up, and suited for gradual exits.

Sell to an external buyer.

Selling to a third party offers cash-out options through competitors, partners, or investors.

Advantages

The business stays within the extended family, familiar with it.

Usually yields the highest business valuation.

Connects sellers with strategic or synergistic buyers.

Ideal for businesses too valuable for family buyers.

Disadvantages

After selling, an owner may struggle adjusting to an employee role.

Seller financing can expose the seller to risk without proper exit planning.

The process typically takes 9-12 months or longer.

It could lead to the loss of customers and employees.

Liquidate the business.

If unsold, the business may be liquidated when assets exceed cash flow value.

Advantages

The process is quick and straightforward.

The owner can liquidate part of the company while keeping the profitable sections.

Disadvantages

Liquidation usually results in the lowest value, focusing only on assets.

Liquidating a company often costs nearly as much as selling an operating business.

Liquidation leads to job losses, negatively affecting the local community.

It may result in losing customers and employees.

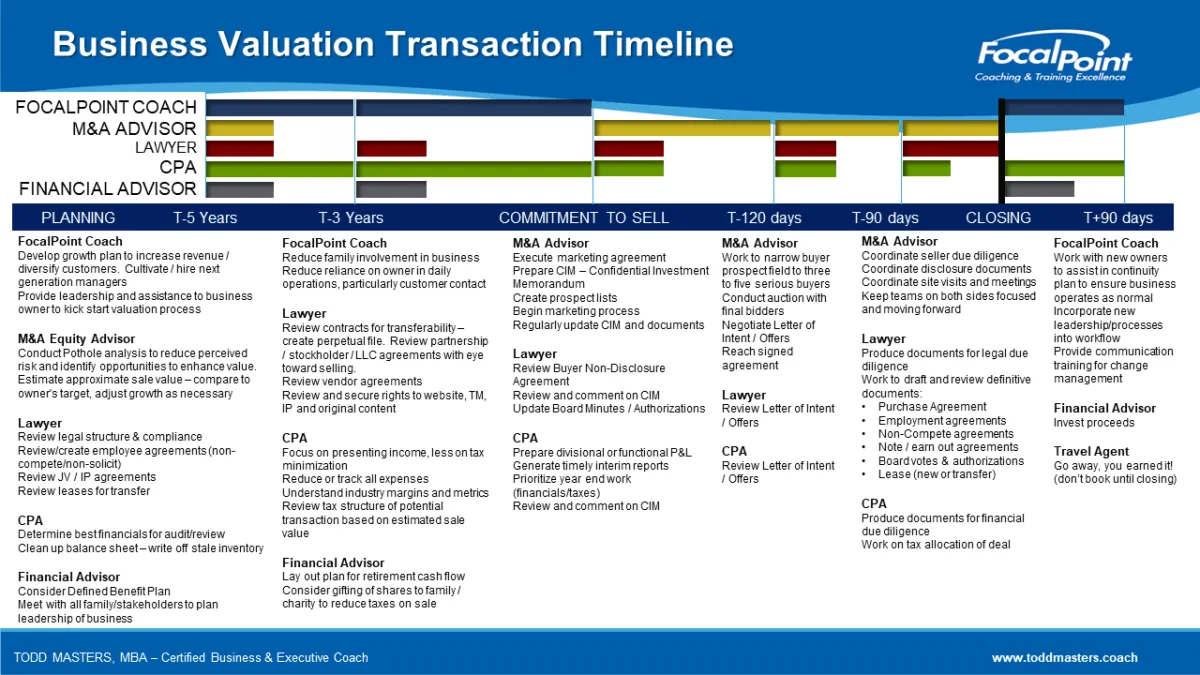

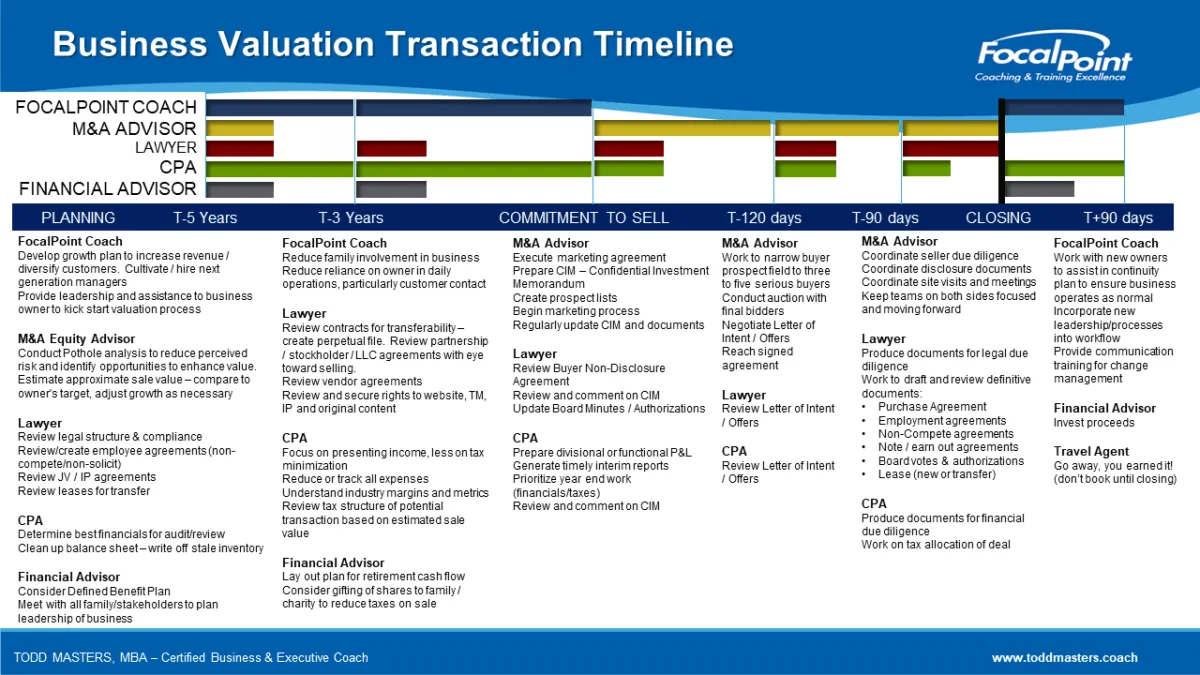

Essential for a Successful Exit

A successful business exit strategy involves 5 key elements:

A written exit plan and documentation aligned with the owner's objectives.

A team of advisors, including a coach, attorney, CPA, financial advisor, banker, and broker.

Positive cash flow and a clear, quantified business value.

A skilled management team.

Adequate preparation time, ideally 3-5 years before retirement.

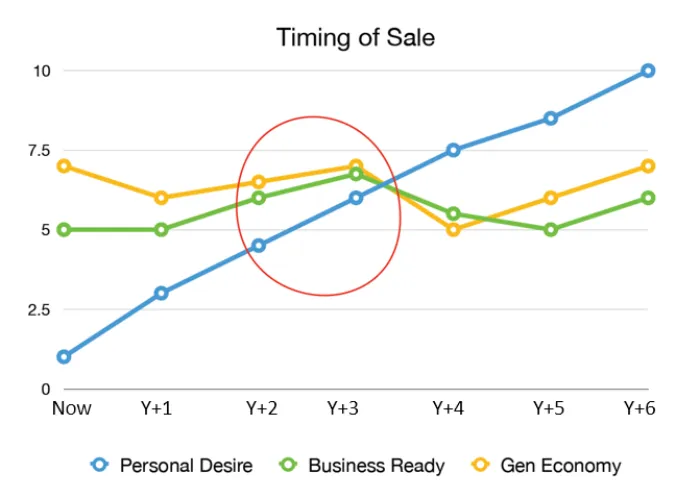

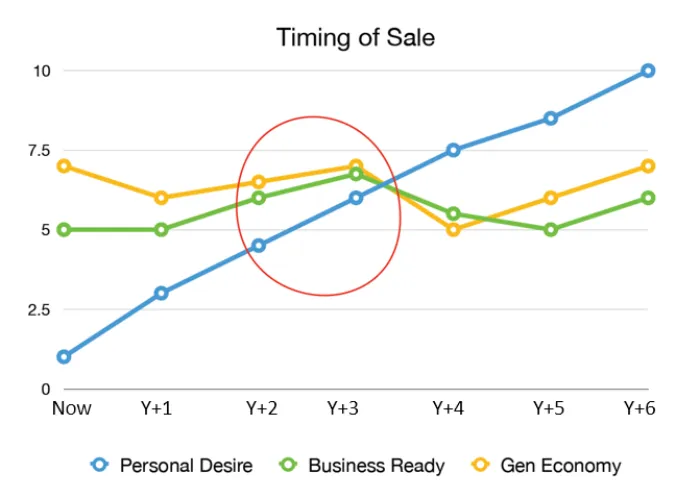

When is the right time to sell?

Timing is crucial!

The right timing is when personal goals, business readiness, and economic conditions align to maximize value.

Personal desire (blue line) typically increases over time as the owner ages, becoming more mentally and hopefully financially ready.

Business readiness may decline as the owner ages, but coaching can speed up the process and boost the business's value.

As a coach, we help owners assess the economy (yellow line), track market trends, and identify key factors for timing, though we can't control it.

Essential for a Successful Exit

A successful business exit strategy involves 5 key elements:

A written exit plan and documentation aligned with the owner's objectives.

A team of advisors, including a coach, attorney, CPA, financial advisor, banker, and broker.

Positive cash flow and a clear, quantified business value.

A skilled management team.

Adequate preparation time, ideally 3-5 years before retirement.

When is the right time to sell?

Timing is crucial!

The right timing is when personal goals, business readiness, and economic conditions align to maximize value.

Personal desire (blue line) typically increases over time as the owner ages, becoming more mentally and hopefully financially ready.

Business readiness may decline as the owner ages, but coaching can speed up the process and boost the business's value.

As a coach, we help owners assess the economy (yellow line), track market trends, and identify key factors for timing, though we can't control it.

This process usually takes 3-5 years, but with effective coaching, it can be accelerated to 12 months or less.

To sell successfully, owners must boost business value and act now.

Train employees

Develop managers

Document systems

Boost sales and profits

Strengthen customer loyalty and recurring revenue

Create a competitive edge

Build a self-sustaining business

To sell successfully, owners must boost business value and act now.

Train employees

Develop managers

Document systems

Boost sales and profits

Strengthen customer loyalty and recurring revenue

Create a competitive edge

Build a self-sustaining business

This process usually takes 3-5 years, but with effective coaching, it can be accelerated to 12 months or less.

Create Your Exit Dream Team

FocalPoint Coach

Your coach will guide the team to find resources and maximize your business value.

M&A Advisor

Your equity advisor will assess your value and work with you and your coach to maximize it.

Lawyer

A good lawyer safeguards your legacy by handling agreements and documents properly.

CPA

Ensure your CPA is qualified to assist with succession and exit planning.

Financial Advisor

Your financial advisor will manage the estate plan for transferring business assets to personal assets.

Create Your Exit Dream Team

FocalPoint Coach

Your coach will guide the team to find resources and maximize your business value.

M&A Advisor

Your equity advisor will assess your value and work with you and your coach to maximize it.

Lawyer

A good lawyer safeguards your legacy by handling agreements and documents properly.

CPA

Ensure your CPA is qualified to assist with succession and exit planning.

Financial Advisor

Your financial advisor will manage the estate plan for transferring business assets to personal assets.

Reach out for trusted referrals from my expert network.

Fast Valuation Assessment

Answer 17 questions to estimate your Capitalization Rate and assess your business exit readiness.

Business coaching defines goals and drives success.

Reach out for trusted referrals from my expert network.

Fast Valuation Assessment

Answer 17 questions to estimate your Capitalization Rate and assess your business exit readiness.

Business coaching defines goals and drives success.

Quick Links

Home

Coach Bio

Coach Bio

Contact

Newsletter

Tools & Tips

Services

Small Business Group Coaching

Entrepreneurial Growth Course

Business Succession Coaching

Executive Coaching Program

Strategy Plan Coaching

Family Succession

Communications Breakthrough

Sales Training

Copyright 2024 . All rights reserved. Privacy Policy

Quick Links

Home

Coach Bio

Coach Bio

Contact

Newsletter

Tools & Tips

Services

Small Business Group Coaching

Entrepreneurial Growth Course

Business Succession Coaching

Executive Coaching Program

Strategy Plan Coaching

Family Succession

Communications Breakthrough

Sales Training