Navigating the Sale of a

Family Business

Preserving your legacy and securing a stable retirement should be your highest priority as a family business owner.

Navigating the Sale of a Family Business

Preserving your legacy and securing a stable retirement should be your highest priority as a family business owner.

Is Your Family Business Fair to Non-Family Employees?

A thriving family business fosters a workplace culture that values non-family employees, treats them with respect, and offers equal opportunities for growth.

I've created a free tool to help ensure your business is prepared for a successful sale or transition—without falling into the trap of 'Outsider Syndrome.

Is Your Family Business Fair to Non-Family Employees?

A thriving family business fosters a workplace culture that values non-family employees, treats them with respect, and offers equal opportunities for growth. I've created a free tool to help ensure your business is prepared for a successful sale or transition—without falling into the trap of 'Outsider Syndrome.

Pros and Cons of Transitioning or Selling to Family Member(s)

Half of business owners plan to pass their business to their children, but less than a third succeed. A backup plan for alternative buyers is essential.

Advantages:

Personal goal: preserving the family legacy by keeping the business within the family.

This option could provide financial stability and career opportunities for younger family members who may not have access to similar earnings outside the family business.

It also allows the original business owner to remain engaged and involved in the business alongside their children.

Moreover, it offers the owner the flexibility to decide on the business’s value on their own terms.

Disadvantages:

May lead to family discord and feelings of unfair treatment among siblings.

Family members typically cannot afford to pay the full price upfront, requiring the selling family member to accept installment payments over time.

Financial security and business performance may decline over time, particularly if the purchasing family member struggles to manage the business effectively.

Family dynamics and unresolved issues could undermine the new owner’s ability to maintain control over the business and its operations.

FINANCIAL STRATEGIES FOR SELLING

Here are the 6 most widely used succession strategies:

Deferred Compensation Plans: These plans allow business owners to defer a portion of their salary or bonuses until a later date, typically after retirement. This provides the owner with a continued income stream while transitioning the business to successors.

Employee Stock Ownership Plans (ESOPs): ESOPs allow employees to become partial owners of the company through stock allocation. As ownership transitions, the owner can still receive compensation as an employee or consultant, benefiting from the appreciation of company stock.

Seller Financing: The business owner can finance the sale of the business to successors through loans or installment payments. This enables the owner to receive regular payments over time while transferring ownership gradually.

Family Limited Partnerships (FLPs): FLPs enable business owners to transfer ownership of assets, including the business, to family members, while retaining control as the general partner. The owner can receive income from the partnership, such as dividends or rental income, while transferring ownership to family members.

Trusts: Trusts allow for the transfer of business ownership to beneficiaries while providing income to the owner through distributions. Trusts offer flexibility in structuring payouts and potential tax advantages.

Consulting Agreements: The owner can enter into a consulting agreement with the new owners or management team, offering advisory services in exchange for compensation. This enables the owner to continue contributing to the business while facilitating the ownership transition.

Each of these financial vehicles offers distinct advantages and considerations, with the ideal choice depending on the owner's goals, the business's nature, tax implications, and the preferences of potential successors.

Succession coaching plays a crucial role in evaluating these options and structuring a plan that aligns with the owner’s objectives, ensuring both financial security and the continued success of the business.

Pros and Cons of Transitioning or Selling to Family Member(s)

Half of business owners plan to pass their business to their children, but less than a third succeed. A backup plan for alternative buyers is essential.

Advantages:

Personal goal: preserving the family legacy by keeping the business within the family.

This option could provide financial stability and career opportunities for younger family members who may not have access to similar earnings outside the family business.

It also allows the original business owner to remain engaged and involved in the business alongside their children.

Moreover, it offers the owner the flexibility to decide on the business’s value on their own terms.

Disadvantages:

May lead to family discord and feelings of unfair treatment among siblings.

Family members typically cannot afford to pay the full price upfront, requiring the selling family member to accept installment payments over time.

Financial security and business performance may decline over time, particularly if the purchasing family member struggles to manage the business effectively.

Family dynamics and unresolved issues could undermine the new owner’s ability to maintain control over the business and its operations.

FINANCIAL STRATEGIES FOR SELLING

Here are the 6 most widely used succession strategies:

Deferred Compensation Plans: These plans allow business owners to defer a portion of their salary or bonuses until a later date, typically after retirement. This provides the owner with a continued income stream while transitioning the business to successors.

Employee Stock Ownership Plans (ESOPs): ESOPs allow employees to become partial owners of the company through stock allocation. As ownership transitions, the owner can still receive compensation as an employee or consultant, benefiting from the appreciation of company stock.

Seller Financing: The business owner can finance the sale of the business to successors through loans or installment payments. This enables the owner to receive regular payments over time while transferring ownership gradually.

Family Limited Partnerships (FLPs): FLPs enable business owners to transfer ownership of assets, including the business, to family members, while retaining control as the general partner. The owner can receive income from the partnership, such as dividends or rental income, while transferring ownership to family members.

Trusts: Trusts allow for the transfer of business ownership to beneficiaries while providing income to the owner through distributions. Trusts offer flexibility in structuring payouts and potential tax advantages.

Consulting Agreements: The owner can enter into a consulting agreement with the new owners or management team, offering advisory services in exchange for compensation. This enables the owner to continue contributing to the business while facilitating the ownership transition.

Each of these financial vehicles offers distinct advantages and considerations, with the ideal choice depending on the owner's goals, the business's nature, tax implications, and the preferences of potential successors.

Succession coaching plays a crucial role in evaluating these options and structuring a plan that aligns with the owner’s objectives, ensuring both financial security and the continued success of the business.

A COMPREHENSIVE ANALYSIS OF THE PROS AND CONS OF FINANCING OPTIONS

Deferred Compensation Plans

Pros:

Enables the owner to postpone a portion of their income to a future date, ensuring financial stability during retirement.

Provides flexibility in terms of payment timing and distribution.

Offers potential tax benefits, as contributions are typically tax-deferred until withdrawn.

Cons:

Subject to regulatory constraints, including contribution limits and vesting schedules.

Future payouts may be influenced by changes in the business's financial performance or stability.

Demands thorough planning and management to ensure compliance with legal and tax regulations.

Employee Stock Ownership Plans (ESOPs)

Pros:

Enables employees to become partial owners, cultivating a sense of ownership and loyalty within the company.

Offers potential tax advantages for the owner, as contributions to ESOPs are often tax-deductible and can help finance the initial loan.

Allows the owner to retain an active role in the business while progressively transferring ownership to employees.

Cons:

Entails substantial administrative and compliance costs for both setup and ongoing maintenance.

May dilute ownership and control, possibly resulting in conflicts or disagreements among shareholders.

Valuing and pricing company stock can be complex and subjective, potentially leading to disputes or challenges.

Seller Financing

Pros:

Enables the sale of the business to successors who may lack access to external financing.

Allows the owner to receive steady, ongoing payments, creating a reliable income stream in retirement.

Offers flexibility in structuring payment terms to align with the buyer's financial capacity.

Cons:

Exposes the owner to the risk of default or non-payment by the buyer, potentially leading to financial loss.

Restricts the owner's liquidity, limiting access to funds for other investments or purposes.

Requires comprehensive due diligence and proper documentation to safeguard the owner's interests and ensure repayment.

Family Limited Partnerships (FLPs)

Pros:

Enables the owner to transfer business ownership to family members while maintaining control as the general partner.

Provides asset protection and estate planning advantages, as assets within the partnership may be protected from creditors and estate taxes.

Offers flexibility in structuring wealth transfers and distributions to future generations.

Cons:

Demands meticulous planning and legal documentation to ensure compliance with partnership laws and regulations.

May result in conflicts or disagreements among family members regarding management and control of the partnership.

Requires ongoing management and compliance to preserve the partnership’s integrity and tax advantages.

Trusts

Pros:

Enables the transfer of business ownership and assets to beneficiaries while retaining control as the trustee.

Offers flexibility in structuring asset distributions and managing resources for the benefit of the beneficiaries.

Provides asset protection and estate planning advantages, as assets held in trust may be safeguarded from creditors and estate taxes.

Cons:

Demands meticulous planning and legal documentation to establish and manage the trust in compliance with relevant trust laws and regulations.

May incur administrative costs and trustee fees, potentially diminishing the overall return on investment.

Can be subject to taxes on income and capital gains, depending on the type of trust and its distribution structure.

Consulting Agreements

Pros:

Enables the owner to continue offering expertise to the business while transitioning ownership to successors.

Provides an income stream for the owner during retirement or as part of the succession strategy.

Facilitates knowledge transfer and ensures operational continuity by utilizing the owner's experience and insights.

Cons:

Requires negotiation and agreement on terms and compensation, which could lead to conflicts or disagreements.

May create dependency on the owner's ongoing involvement, limiting the autonomy and decision-making authority of successors.

Can present challenges in balancing the owner's role as a consultant with the new management's authority and responsibilities.

A COMPREHENSIVE ANALYSIS OF THE PROS AND CONS OF FINANCING OPTIONS

Deferred

Compensation Plans

Pros:

Enables the owner to postpone a portion of their income to a future date, ensuring financial stability during retirement.

Provides flexibility in terms of payment timing and distribution.

Offers potential tax benefits, as contributions are typically tax-deferred until withdrawn.

Cons:

Subject to regulatory constraints, including contribution limits and vesting schedules.

Future payouts may be influenced by changes in the business's financial performance or stability.

Demands thorough planning and management to ensure compliance with legal and tax regulations.

Employee Stock Ownership Plans (ESOPs)

Pros:

Enables employees to become partial owners, cultivating a sense of ownership and loyalty within the company.

Offers potential tax advantages for the owner, as contributions to ESOPs are often tax-deductible and can help finance the initial loan.

Allows the owner to retain an active role in the business while progressively transferring ownership to employees.

Cons:

Entails substantial administrative and compliance costs for both setup and ongoing maintenance.

May dilute ownership and control, possibly resulting in conflicts or disagreements among shareholders.

Valuing and pricing company stock can be complex and subjective, potentially leading to disputes or challenges.

Seller Financing

Pros:

Enables the sale of the business to successors who may lack access to external financing.

Allows the owner to receive steady, ongoing payments, creating a reliable income stream in retirement.

Offers flexibility in structuring payment terms to align with the buyer's financial capacity.

Cons:

Exposes the owner to the risk of default or non-payment by the buyer, potentially leading to financial loss.

Restricts the owner's liquidity, limiting access to funds for other investments or purposes.

Requires comprehensive due diligence and proper documentation to safeguard the owner's interests and ensure repayment.

Family Limited Partnerships (FLPs)

Pros:

Enables the owner to transfer business ownership to family members while maintaining control as the general partner.

Provides asset protection and estate planning advantages, as assets within the partnership may be protected from creditors and estate taxes.

Offers flexibility in structuring wealth transfers and distributions to future generations.

Cons:

Demands meticulous planning and legal documentation to ensure compliance with partnership laws and regulations.

May result in conflicts or disagreements among family members regarding management and control of the partnership.

Requires ongoing management and compliance to preserve the partnership’s integrity and tax advantages.

Trusts

Pros:

Enables the transfer of business ownership and assets to beneficiaries while retaining control as the trustee.

Offers flexibility in structuring asset distributions and managing resources for the benefit of the beneficiaries.

Provides asset protection and estate planning advantages, as assets held in trust may be safeguarded from creditors and estate taxes.

Cons:

Demands meticulous planning and legal documentation to establish and manage the trust in compliance with relevant trust laws and regulations.

May incur administrative costs and trustee fees, potentially diminishing the overall return on investment.

Can be subject to taxes on income and capital gains, depending on the type of trust and its distribution structure.

Consulting Agreements

Pros:

Enables the owner to continue offering expertise to the business while transitioning ownership to successors.

Provides an income stream for the owner during retirement or as part of the succession strategy.

Facilitates knowledge transfer and ensures operational continuity by utilizing the owner's experience and insights.

Cons:

Requires negotiation and agreement on terms and compensation, which could lead to conflicts or disagreements.

May create dependency on the owner's ongoing involvement, limiting the autonomy and decision-making authority of successors.

Can present challenges in balancing the owner's role as a consultant with the new management's authority and responsibilities.

Which Option Suits You Best?

IT ALL DEPENDS ON YOU!

I know that’s not the answer you were hoping for, but with so many factors involved, there’s no one-size-fits-all solution. Let’s talk—I’ll help you explore your options and, when the time is right, connect you with the right people to guide your next steps.

Maintain Clear and Open Communication

Clear, open communication is essential when transferring a business to a family member. A business coach may suggest honest discussions to align expectations, define sale terms, and address conflicts. Transparency from the start ensures a smooth transition and a shared vision for the future.

Conduct a Thorough Business Valuation

A professional valuation is key to determining the business's fair market value. A business coach may suggest hiring an expert appraiser for an objective assessment. This ensures both parties have a clear, realistic understanding of the business's worth, leading to fair and informed negotiations.

Finalize the Sale Agreement

To ensure a smooth transition and protect both parties, a business coach may recommend a detailed sale agreement. This document should define key terms such as price, payment structure, transition plan, and contingencies. A legally binding agreement provides clarity, minimizes conflicts, and aligns expectations.

Which Option Suits You Best?

IT ALL DEPENDS ON YOU!

I know that’s not the answer you were hoping for, but with so many factors involved, there’s no one-size-fits-all solution. Let’s talk—I’ll help you explore your options and, when the time is right, connect you with the right people to guide your next steps.

Maintain Clear and Open Communication

Clear, open communication is essential when transferring a business to a family member. A business coach may suggest honest discussions to align expectations, define sale terms, and address conflicts. Transparency from the start ensures a smooth transition and a shared vision for the future.

Conduct a Thorough Business Valuation

A professional valuation is key to determining the business's fair market value. A business coach may suggest hiring an expert appraiser for an objective assessment. This ensures both parties have a clear, realistic understanding of the business's worth, leading to fair and informed negotiations.

Finalize the Sale Agreement

To ensure a smooth transition and protect both parties, a business coach may recommend a detailed sale agreement. This document should define key terms such as price, payment structure, transition plan, and contingencies. A legally binding agreement provides clarity, minimizes conflicts, and aligns expectations.

Which Option Suits You Best?

That Depends!

I know that’s a frustrating answer, but with so many variables at play, there’s no one-size-fits-all solution. Let’s chat—I’ll help you navigate your options and, when the time is right, connect you with the right people.

Okay, after choosing the financial vehicle, what's next?

By following these recommendations, you can confidently sell your business to a family member, ensuring a smooth transition, preserving family harmony, and maximizing value for both parties.

Ensure Clear Communication:

Clear and open communication is crucial when selling a business to a family member.

A business coach may recommend honest discussions to align intentions, expectations, and sale terms.

This includes resolving potential conflicts of interest and ensuring shared goals and objectives.

Perform a Professional Valuation:

Determining the business's fair market value through a professional valuation is essential.

A business coach may suggest hiring a qualified appraiser for an objective assessment.

This helps both parties understand the business's true worth and negotiate fair terms.

Finalize the Sale Agreement

To ensure a smooth sale and protect both parties, a business coach may recommend drafting a detailed sale agreement.

This should include the purchase price, payment terms, transition plan, and any contingencies or warranties.

A legally binding agreement helps prevent misunderstandings and future disputes.

Explore Financing Options

A business coach may recommend exploring financing options based on the buyer’s financial resources.

ptions include seller financing, where the owner provides a loan, or external funding from banks or lenders.

The coach can assess feasibility and structure the financing to benefit both parties.

Develop a Succession and Transition Plan

Selling a business to a family member requires both ownership transfer and leadership transition.

As your coach, I will help you create a succession plan that defines roles, identifies key stakeholders, and ensures operational continuity.

This plan will cover training, new management integration, and clear communication with employees and stakeholders.

Consult a Professional Expert

Selling a business to a family member involves complex emotions and requires balancing family and business dynamics.

As your coach, I will connect you with experienced legal, financial, and tax professionals for expert advice.

These specialists will help structure the sale, manage tax implications, and ensure legal compliance.

Which Option Suits You Best?

That Depends!

I know that’s a frustrating answer, but with so many variables at play, there’s no one-size-fits-all solution. Let’s chat—I’ll help you navigate your options and, when the time is right, connect you with the right people.

Okay, after choosing the financial vehicle, what's next?

By following these recommendations, you can confidently sell your business to a family member, ensuring a smooth transition, preserving family harmony, and maximizing value for both parties.

Ensure Clear Communication:

Clear and open communication is crucial when selling a business to a family member.

A business coach may recommend honest discussions to align intentions, expectations, and sale terms.

This includes resolving potential conflicts of interest and ensuring shared goals and objectives.

Perform a Professional Valuation:

Determining the business's fair market value through a professional valuation is essential.

A business coach may suggest hiring a qualified appraiser for an objective assessment.

This helps both parties understand the business's true worth and negotiate fair terms.

Finalize the Sale Agreement

To ensure a smooth sale and protect both parties, a business coach may recommend drafting a detailed sale agreement.

This should include the purchase price, payment terms, transition plan, and any contingencies or warranties.

A legally binding agreement helps prevent misunderstandings and future disputes.

Explore Financing Options

A business coach may recommend exploring financing options based on the buyer’s financial resources.

ptions include seller financing, where the owner provides a loan, or external funding from banks or lenders.

The coach can assess feasibility and structure the financing to benefit both parties.

Develop a Succession and Transition Plan

Selling a business to a family member requires both ownership transfer and leadership transition.

As your coach, I will help you create a succession plan that defines roles, identifies key stakeholders, and ensures operational continuity.

This plan will cover training, new management integration, and clear communication with employees and stakeholders.

Consult a Professional Expert

Selling a business to a family member involves complex emotions and requires balancing family and business dynamics.

As your coach, I will connect you with experienced legal, financial, and tax professionals for expert advice.

These specialists will help structure the sale, manage tax implications, and ensure legal compliance.

To sell successfully, business owners must boost value with key steps now.

Train employees effectively

Develop strong management teams

Document key business systems

Boost sales and profitability

Build long-term customer relationships and recurring revenue

Establish a competitive advantage

Create a self-sustaining business

You must START YOUR EXIT PLANNING NOW!

This process usually takes 3-5 yeaars.

With expert coaching, this process can be accelerated to 12 months or less.

To sell successfully, business owners must boost value with key steps now.

Train employees effectively

Develop strong management teams

Document key business systems

Boost sales and profitability

Build long-term customer relationships and recurring revenue

Establish a competitive advantage

Create a self-sustaining business

You must START YOUR EXIT PLANNING NOW!

This process usually takes 3-5 yeaars.

With expert coaching, this process can be accelerated to 12 months or less.

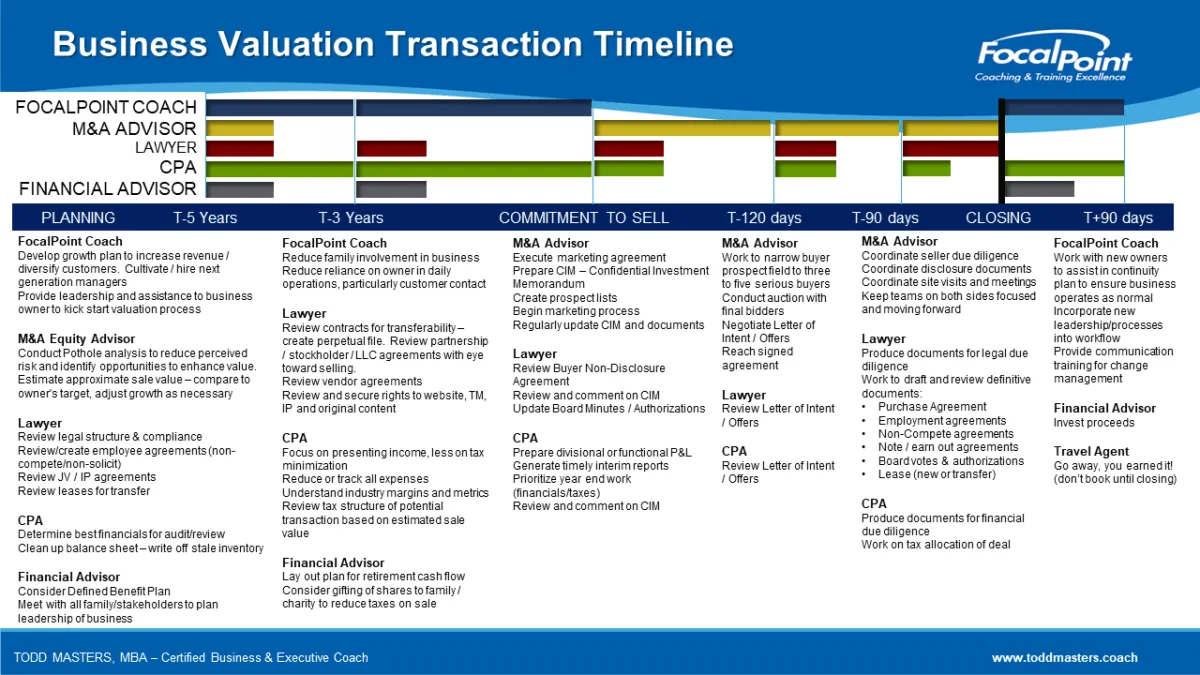

Create Your Exit Dream Team

FocalPoint Coach

Your coach will guide the team to find resources and maximize your business value.

M&A Advisor

Your equity advisor will assess your value and work with you and your coach to maximize it.

Lawyer

A good lawyer safeguards your legacy by handling agreements and documents properly.

CPA

Ensure your CPA is qualified to assist with succession and exit planning.

Financial Advisor

Your financial advisor will manage the estate plan for transferring business assets to personal assets.

Create Your Exit

Dream Team

FocalPoint Coach

Your coach will guide the team to find resources and maximize your business value.

M&A Advisor

Your equity advisor will assess your value and work with you and your coach to maximize it.

Lawyer

A good lawyer safeguards your legacy by handling agreements and documents properly.

CPA

Ensure your CPA is qualified to assist with succession and exit planning.

Financial Advisor

Your financial advisor will manage the estate plan for transferring business assets to personal assets.

Reach out for trusted referrals from my expert network.

Fast Valuation Assessment

Answer 17 questions to estimate your Capitalization Rate and assess your business exit readiness.

Take a free, quick business valuation assessment.

Business coaching defines goals and drives success.

Quick Links

Home

Coach Bio

Coach Bio

Contact

Newsletter

Tools & Tips

Services

Small Business Group Coaching

Entrepreneurial Growth Course

Business Succession Coaching

Executive Coaching Program

Strategy Plan Coaching

Family Succession

Communications Breakthrough

Sales Training

Copyright 2024 . All rights reserved. Privacy Policy

Quick Links

Home

Coach Bio

Coach Bio

Contact

Newsletter

Tools & Tips

Services

Small Business Group Coaching

Entrepreneurial Growth Course

Business Succession Coaching

Executive Coaching Program

Strategy Plan Coaching

Family Succession

Communications Breakthrough

Sales Training